how are qualified annuities taxed

The taxation of qualified annuities is relatively simple. This means you will pay taxes as normal income in the year you take a distribution or cash it out.

Optimizing Fixed Annuity Tax Deferral Aaron Brask Capital

Then when you start taking distributions from the annuity those withdrawals are taxed as ordinary income.

. How are non-qualified annuities taxed. You only pay taxes on it when you take a withdrawal or begin payouts. Qualified annuities permit individuals to defer taxation on an investment earnings stream as long as withdrawals are made according to IRS guidelines.

Qualified annuities require those who inherit them to pay taxes on all of the withdrawals. A portion of the income is considered a return of principal. The money you put into the annuity up to the annual contribution limit is deducted from your taxable income and all of the earnings on the account grow tax-deferred.

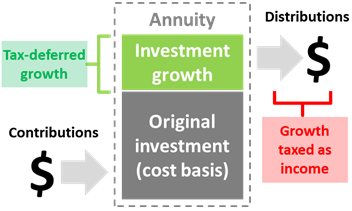

Heres why the distinction matters. Qualified annuities are purchased with pre-tax funds while non-qualified annuities are funded with money on which taxes have been paid. Qualified annuities are funded with pre-tax dollars.

Withdrawals are taxed the same way they are during the deferrals stage gains first at ordinary income rates. There are two ways to get income from a non-qualified variable annuity withdrawals and an annuity option. When using a qualified annuity such as one in an employers.

Withdrawals from a qualified annuity which again are begun with pre-tax dollars will taxed as ordinary income when you take them out. 2 rows If an annuity is funded with money on which no taxes have been previously paid then its. At that point the money you receive is taxed at the same rate as your ordinary income.

When you receive payments from a qualified annuity those payments are fully taxable as income. Typically these annuities are funded with money from 401ks or other tax-deferred retirement accounts. If an annuity is funded with money in which no taxes have been paid then this is a qualified annuity.

A qualified annuity allows you to fund your account with pre-tax dollars. The money you put into a qualified annuity grows tax deferred. You will need to pay ordinary taxes on the distribution amount.

Non-qualified annuities are funded with after-tax dollars. If the contract was purchased with after-tax funds meaning. What youll pay in taxes for an inherited annuity can depend on whether the annuity is qualified or non-qualified.

How Qualified Annuities Are Taxed A qualified annuity is funded with pre-tax dollars like an IRA or 401 k rollover. You may also have to. Annuity income is taxed more favorably.

3 Tax on Withdrawals and Income When you receive money from a nonqualified variable annuity only your net. When you withdraw money from a qualified annuity all of it is taxed as regular income. Qualified annuities are those purchased through a qualified plan like a 401 k or SIMPLE IRA and are normally paid for with pre-tax dollars.

There are specific eligibility requirements for your annuities to be tax-free under these circumstances. However you may have tax-free annuities if you purchased annuities with a Roth IRA or 401 k. These annuities are often started with money from a lump-sum distribution from a 401k account a similar employer retirement plan with pre-tax contributions or an IRA.

Contributions to qualified annuities are deducted from an investors gross earnings and along with investments grow tax-free. Qualified Annuity Taxation. A qualified annuity is one that you purchase with money that hasnt already been taxed like pre-tax contributions taken from your paycheck and invested in a 401k or your tax-deferred contributions to your IRA up to IRS limits.

In this case the tax rules governing qualified plans and IRAs essentially trump the annuity tax rules which generally means that the full annuity payout is taxed as ordinary income. Its very similar to an IRA account. 4 rows Qualified Annuity Taxes.

But if you withdraw money from a non-qualified annuity only the earnings are taxed as regular income. Qualified annuity plans allow taxpayers to lower their taxable income by contributing pre-tax funds to an annuity premium. Nonqualified variable annuities dont entitle you to a tax deduction for your contributions but your investment will grow tax-deferredWhen you make withdrawals or begin taking regular payments from the annuity that money will be taxed as ordinary income.

Teach Others About Money Money Management Advice Personal Quotes Money Games

Qualified Vs Non Qualified Annuities Taxation And Distribution

Taxation On Annuities Annuity Tax Information Lifeannuities Com

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Various Annuities Are Taxed

How Are Annuities Taxed For Retirement The Annuity Expert

Pin On Words Of Life By My Beloved

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Taxation On Annuities Annuity Tax Information Lifeannuities Com

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Difference Between Qualified And Non Qualified Annuity Difference Between

Annuity Taxation How Various Annuities Are Taxed

How Much Taxes Should I Plan On Paying For My Annuity Valuewalk

The Fers Special Retirement Supplement Retirement Federal Retirement Supplements